A New Market Opportunity

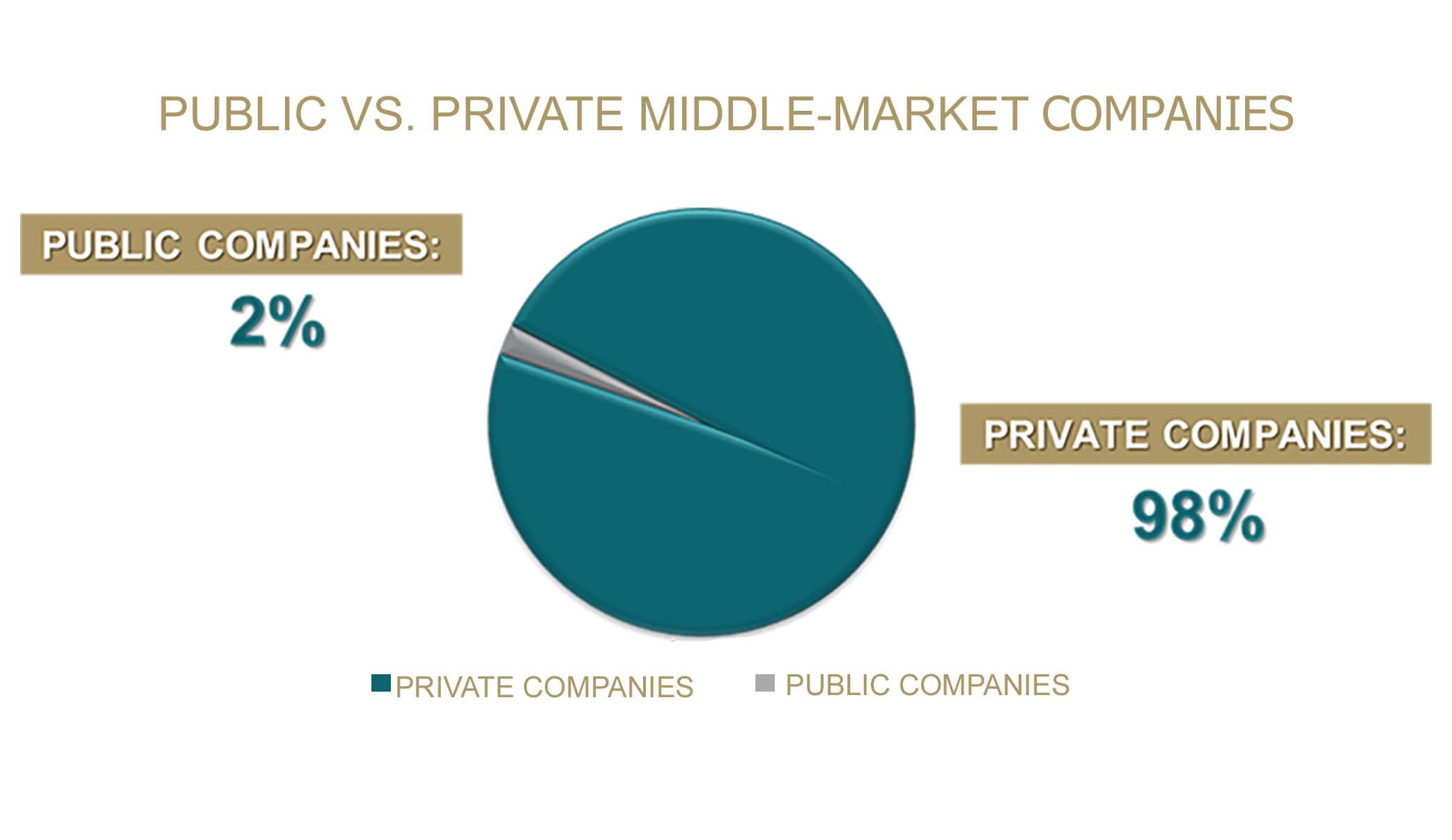

CNL Strategic Capital focuses on middle-market businesses primarily with annual revenues between $15 million and $250 million. These are companies that you may already know. In fact, you may work for one or know someone who does. Of the more than 100,000 companies that fit the middle-market definition, 98%— or more than 99,000— are privately owned.

Investing in private companies may provide:

- Access to a unique asset class for individual investors

- Diversification outside of the publicly traded markets1

There is no assurance the stated objectives will be met.

Source: “Public companies with revenues of $15m-$250m,” Dun & Bradstreet. “Private companies with revenues of $15m-$250m,” Dun & Bradstreet. All data as of Nov. 9, 2023.

¹ Diversification does not ensure profit nor protection against loss. There is no guarantee that any investment will achieve its objectives, generate profits or avoid losses.